Building a Real-Time Financial Intelligence Engine: RAG with Gemini and Qdrant

Introduction: The Evolution of Financial Analysis

The financial sector thrives on information. In the high-frequency world of trading and investment analysis, the difference between profit and loss often comes down to milliseconds and the accuracy of data interpretation. Traditional methods of analyzing financial news involves manual reading or basic keyword scraping, which are either too slow or lack nuance. However, the advent of Generative AI has revolutionized this landscape. By leveraging Retrieval-Augmented Generation (RAG), developers can build systems that not only retrieve real-time data but also reason over it to provide actionable insights.

This article explores the technical architecture required to build a real-time financial news chatbot. We will utilize Google’s Gemini for its superior reasoning capabilities and large context window, paired with Qdrant, a high-performance vector search engine, to handle the storage and retrieval of high-dimensional data. Keeping up with Qdrant News is essential, as their recent updates regarding hybrid search and quantization have made them a top choice for low-latency financial applications.

While tools like ChatGPT (often discussed in OpenAI News) popularized the chat interface, the integration of external, real-time knowledge bases via RAG is what transforms a chatbot into a financial analyst. Throughout this guide, we will touch upon the broader ecosystem, including insights from LangChain News and LlamaIndex News, to demonstrate how to orchestrate these complex pipelines effectively.

Section 1: The Architecture of Financial RAG

A robust RAG system for finance differs significantly from a standard document chat application. Financial data is time-sensitive, highly structured (tickers, dates, sentiment), and requires strict accuracy. Hallucinations—a common topic in Google DeepMind News and Anthropic News—are unacceptable when dealing with investment advice.

The Core Components

The architecture consists of three main pillars:

- The Ingestion Pipeline: Real-time fetching of news articles, earnings call transcripts, and market reports. This data must be cleaned, chunked, and embedded.

- The Vector Engine (Qdrant): Stores embeddings and, crucially for finance, the metadata. Qdrant’s ability to perform pre-filtering (e.g., “only search news related to AAPL from the last 24 hours”) is a game-changer.

- The Reasoning Engine (Gemini): Takes the retrieved context and the user query to generate a synthesized answer.

When selecting your embedding models, it is worth monitoring Hugging Face News and Sentence Transformers News. While Gemini has built-in embeddings, specialized financial models (often found on the Hugging Face Hub) can sometimes offer better semantic understanding of jargon like “EBITDA” or “quantitative easing.”

Setting Up the Environment

To begin, we need to initialize our connection to Qdrant and configure the Gemini API. We will use the Qdrant Python client and Google’s Generative AI SDK. This setup assumes you are familiar with basic Python environments, similar to workflows discussed in Google Colab News or Kaggle News.

import os

import google.generativeai as genai

from qdrant_client import QdrantClient

from qdrant_client.http import models

# Configuration

GOOGLE_API_KEY = os.getenv("GOOGLE_API_KEY")

QDRANT_URL = os.getenv("QDRANT_URL")

QDRANT_API_KEY = os.getenv("QDRANT_API_KEY")

# Initialize Gemini

genai.configure(api_key=GOOGLE_API_KEY)

model = genai.GenerativeModel('gemini-pro')

# Initialize Qdrant Client

qdrant = QdrantClient(

url=QDRANT_URL,

api_key=QDRANT_API_KEY

)

# Create a collection for financial news

# We use Cosine distance, standard for text embeddings

collection_name = "financial_news_stream"

vector_size = 768 # Depends on the embedding model used

# Check if collection exists, if not create it

if not qdrant.collection_exists(collection_name):

qdrant.create_collection(

collection_name=collection_name,

vectors_config=models.VectorParams(

size=vector_size,

distance=models.Distance.COSINE

)

)

print(f"Collection '{collection_name}' created successfully.")

else:

print(f"Collection '{collection_name}' already exists.")Section 2: Ingestion and Vectorization Strategies

The quality of your chatbot depends entirely on the quality of the data in your vector store. In the context of Milvus News, Pinecone News, and Weaviate News, the consensus is clear: garbage in, garbage out. For finance, we need to implement a “sliding window” chunking strategy to ensure context isn’t lost across split boundaries.

Handling Real-Time Data Streams

Financial news moves fast. You might be pulling data from APIs like Alpha Vantage or scraping trusted sources. Once the text is acquired, it must be embedded. While OpenAI News often highlights their embedding models, Google’s Gecko or similar models available via Vertex AI are highly capable. For this example, we will simulate an embedding function compatible with Gemini’s ecosystem.

Furthermore, metadata is critical. You must tag every vector with the ticker symbol, publication timestamp, and source authority. This allows for the filtering capabilities that distinguish a toy project from a professional tool.

from datetime import datetime

import uuid

def get_embeddings(text):

"""

Wrapper to get embeddings using Google's embedding model.

In a real app, handle rate limits and batching.

"""

result = genai.embed_content(

model="models/embedding-001",

content=text,

task_type="retrieval_document",

title="Financial News"

)

return result['embedding']

def ingest_news_article(title, content, ticker, source):

"""

Processes a news article and stores it in Qdrant.

"""

# 1. Chunking (Simplified for brevity)

# In production, use LangChain's RecursiveCharacterTextSplitter

chunks = [content[i:i+500] for i in range(0, len(content), 500)]

points = []

for i, chunk in enumerate(chunks):

# 2. Generate Embedding

vector = get_embeddings(chunk)

# 3. Prepare Payload (Metadata)

payload = {

"title": title,

"content": chunk,

"ticker": ticker,

"source": source,

"timestamp": datetime.now().isoformat(),

"chunk_index": i

}

# 4. Create PointStruct

points.append(models.PointStruct(

id=str(uuid.uuid4()),

vector=vector,

payload=payload

))

# 5. Upsert to Qdrant

qdrant.upsert(

collection_name="financial_news_stream",

points=points

)

print(f"Ingested {len(points)} chunks for {ticker} from {source}")

# Example Usage

news_content = """

NVIDIA (NVDA) reported record-breaking revenue in its data center division,

driven by insatiable demand for H100 GPUs. Analysts have raised price targets...

"""

ingest_news_article("NVIDIA Q3 Earnings", news_content, "NVDA", "MarketWatch")This ingestion process aligns with best practices seen in Haystack News and Apache Spark MLlib News regarding data pipeline construction. By structuring the payload effectively, we prepare the system for complex queries later.

Section 3: Advanced Retrieval and Generation

Now that the data is indexed, we move to the retrieval phase. This is where the “R” in RAG happens. A naive approach would be to just search for vectors close to the user’s query. However, in finance, if a user asks “How did Apple perform today?”, searching the entire database is inefficient and potentially inaccurate if it retrieves old news.

Implementing Hybrid Search and Filtering

We must utilize Qdrant’s filtering capabilities to narrow the search space before performing the vector similarity check. This concept is frequently discussed in Elasticsearch News and MongoDB Atlas Vector Search News, but Qdrant handles it with exceptional speed.

Additionally, we use Gemini to synthesize the answer. We construct a prompt that forces the model to act as a financial analyst, citing its sources. This approach is central to “Grounding,” a topic popular in Vertex AI News and Azure AI News.

def financial_rag_chat(user_query, target_ticker=None):

"""

Performs RAG to answer financial queries with optional ticker filtering.

"""

# 1. Embed the user query

query_vector = genai.embed_content(

model="models/embedding-001",

content=user_query,

task_type="retrieval_query"

)['embedding']

# 2. Define Filters (if ticker is provided)

query_filter = None

if target_ticker:

query_filter = models.Filter(

must=[

models.FieldCondition(

key="ticker",

match=models.MatchValue(value=target_ticker)

)

]

)

# 3. Retrieve Context from Qdrant

search_result = qdrant.search(

collection_name="financial_news_stream",

query_vector=query_vector,

query_filter=query_filter,

limit=5 # Retrieve top 5 most relevant chunks

)

# 4. Construct Context String

context_text = "\n\n".join([hit.payload['content'] for hit in search_result])

sources = set([hit.payload['source'] for hit in search_result])

# 5. Generate Answer with Gemini

prompt = f"""

You are a senior financial analyst. Use the following real-time news context to answer the user's question.

If the answer is not in the context, state that you do not have enough information.

CONTEXT:

{context_text}

USER QUESTION:

{user_query}

ANALYSIS:

"""

response = model.generate_content(prompt)

return {

"answer": response.text,

"sources": list(sources)

}

# Example Usage

result = financial_rag_chat("What is driving the growth in data center revenue?", target_ticker="NVDA")

print(f"Answer: {result['answer']}")

print(f"Sources: {result['sources']}")This implementation highlights the power of combining deterministic filtering with probabilistic vector search. Following LangChain News, one might also implement a “Re-ranking” step using tools like Cohere (see Cohere News) to further refine the top 5 results before sending them to the LLM, ensuring maximum relevance.

Section 4: Best Practices, Optimization, and Deployment

Building a prototype is one thing; deploying a production-grade financial tool is another. Here are critical considerations derived from trends in MLOps News and Data Engineering News.

1. Latency and Caching

Financial users demand speed. To optimize, consider caching frequent queries. Tools like Redis or semantic caching layers (often discussed in Momento News) can prevent redundant calls to the embedding API and the Vector DB. Furthermore, using ONNX News or TensorRT News techniques to optimize embedding models can shave off milliseconds.

2. Continuous Evaluation

How do you know your RAG system is accurate? You must implement evaluation pipelines. LangSmith News and Arize AI News have highlighted the importance of tracing and evaluating LLM outputs. You should log every query and response, and periodically use a stronger model (like Gemini Ultra or GPT-4) to grade the responses of your production model.

3. Data Freshness and Lifecycle Management

Financial news becomes stale quickly. In Qdrant, you can set up Time-to-Live (TTL) policies or background jobs to delete old vectors. This keeps your index lean and relevant. Monitoring tools like Grafana or specific ML monitoring from Weights & Biases News can help track the size and health of your vector collections.

4. User Interface

For the frontend, Python developers often turn to Streamlit News or Gradio News for rapid prototyping. However, for a robust financial dashboard, a backend using FastAPI News coupled with a React frontend is standard. This separation allows for better scalability and security handling.

5. Regulatory Compliance

When dealing with finance, data privacy is paramount. Ensure that you are not sending PII (Personally Identifiable Information) to the LLM providers. Techniques discussed in Private AI News and Confidential Computing News should be applied. Using local LLMs (via Ollama News or vLLM News) is an alternative if data sovereignty is a strict requirement, though Gemini offers robust enterprise data protections.

Conclusion

Building a real-time financial news RAG chatbot with Gemini and Qdrant represents the cutting edge of Fintech application development. By combining the vast analytical context of Gemini with the speed and precision of Qdrant’s vector search, developers can create tools that empower investors to make data-driven decisions faster than ever before.

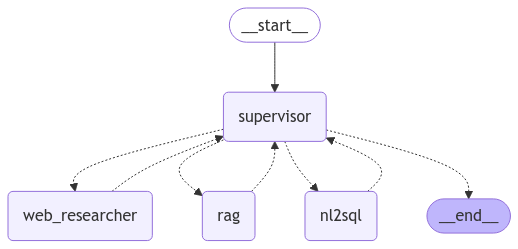

As the ecosystem evolves, keeping an eye on Google Cloud News for Gemini updates and Qdrant News for database optimizations will be crucial. We are moving toward agentic workflows—where the AI doesn’t just answer questions but actively monitors markets and alerts users. This transition, often highlighted in AutoGPT News and BabyAGI News, is the next frontier.

Start small: build the ingestion pipeline, test the retrieval accuracy, and then refine the reasoning prompts. The code provided here serves as a solid foundation for your journey into financial AI.