Building a Financial Intelligence Engine: Advanced RAG with Qdrant, LlamaIndex, and Gemini

Introduction: The Evolution of Financial Analysis in the AI Era

In the high-frequency world of finance, information is the most valuable currency. Investors, analysts, and fintech developers are constantly seeking an edge, often drowning in a sea of earnings reports, market sentiment analysis, and breaking news. The traditional method of keyword searching through databases is no longer sufficient. The rise of Generative AI has ushered in a new paradigm: Retrieval-Augmented Generation (RAG). By combining the reasoning capabilities of Large Language Models (LLMs) with the precise retrieval of Vector Databases, we can build systems that don’t just search for data but understand it.

This article explores the technical architecture required to build a robust Financial News Chatbot. We will leverage a powerful stack comprising Qdrant for vector storage, LlamaIndex for data orchestration, and Google Gemini for embedding and generation. This combination represents the cutting edge of Qdrant News and LlamaIndex News, offering a scalable, low-latency solution for processing complex financial datasets.

While headlines in OpenAI News and Anthropic News often dominate the conversation, the integration of Google’s Gemini models offers a compelling context window and reasoning capability essential for dissecting financial jargon. Furthermore, by employing advanced query transformation techniques like HyDE (Hypothetical Document Embeddings), we can bridge the semantic gap between a user’s short question and the dense, technical content of financial reports.

Section 1: The Architecture of a Financial RAG System

Before writing code, it is crucial to understand the architectural components. A financial RAG system differs from a standard chatbot because accuracy and provenance are non-negotiable. Hallucinations in creative writing are acceptable; in finance, they are dangerous.

The Role of Vector Databases

Financial news streams are continuous. A static index is useless. This is where Qdrant shines. Unlike older search technologies, Qdrant is a vector similarity search engine designed for production. It supports real-time indexing and filtering, which allows us to segment news by ticker symbol, date, or source authority. In the context of Milvus News, Pinecone News, and Weaviate News, Qdrant distinguishes itself with its Rust-based architecture, offering exceptional performance and memory safety.

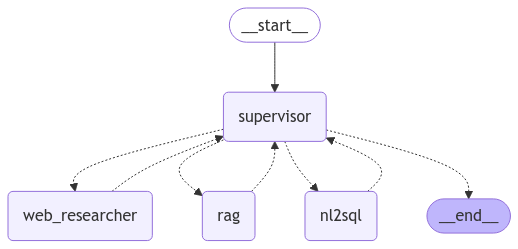

The Orchestration Layer

LlamaIndex serves as the glue. It handles the ingestion pipeline—loading data, chunking text, and managing the interaction between the LLM and the database. Recent LlamaIndex News highlights its shift towards agentic workflows, but its core strength remains in building structured indices over unstructured data.

The Cognitive Engine

We utilize Google Gemini via the API. Gemini provides both the embedding model (to turn text into numbers) and the generative model (to synthesize answers). Keeping up with Google DeepMind News, Gemini’s multimodal capabilities and large context windows make it ideal for synthesizing trends across multiple documents.

Prerequisites and Setup

To begin, ensure you have a Python environment set up. We will need specific libraries to bridge these tools. Whether you are following TensorFlow News or PyTorch News, LlamaIndex abstracts much of the underlying tensor operations, but having a foundational understanding helps.

# Installation of necessary packages

# pip install llama-index qdrant-client llama-index-vector-stores-qdrant llama-index-llms-gemini llama-index-embeddings-gemini python-dotenv

import os

from dotenv import load_dotenv

# Load API keys

load_dotenv()

GOOGLE_API_KEY = os.getenv("GOOGLE_API_KEY")

# Import core LlamaIndex components

from llama_index.core import (

VectorStoreIndex,

SimpleDirectoryReader,

StorageContext,

Settings

)

from llama_index.vector_stores.qdrant import QdrantVectorStore

from llama_index.llms.gemini import Gemini

from llama_index.embeddings.gemini import GeminiEmbedding

import qdrant_client

# Configure Global Settings

# We use Gemini Pro for generation and the embedding-001 model for vectorization

Settings.llm = Gemini(model="models/gemini-pro", api_key=GOOGLE_API_KEY)

Settings.embed_model = GeminiEmbedding(model_name="models/embedding-001", api_key=GOOGLE_API_KEY)

print("Environment configured successfully.")Section 2: Ingestion and Indexing Financial Data

The quality of your chatbot is directly proportional to the quality of your data ingestion pipeline. Financial news articles can range from short tweets to long-form analysis. Simply dumping text into a database will result in poor retrieval. We must chunk the data intelligently.

Connecting to Qdrant

We can run Qdrant locally using Docker or use their managed cloud service. For this tutorial, we will simulate a local instance. This flexibility is a key talking point in Qdrant News, allowing developers to prototype locally and scale to the cloud without code changes.

The following code demonstrates how to load a dataset (simulated here as a directory of text files representing news) and index it into Qdrant. Note that if you were building a production system, you might look into Apache Spark MLlib News or Ray News for parallel processing of massive historical datasets, but LlamaIndex handles moderate datasets efficiently.

def create_financial_index(documents_path="./financial_news_data"):

# 1. Initialize Qdrant Client

# In memory for tutorial, use path or url for persistence

client = qdrant_client.QdrantClient(location=":memory:")

# 2. Define the Vector Store

# We create a collection named 'financial_news'

vector_store = QdrantVectorStore(client=client, collection_name="financial_news")

# 3. Create Storage Context

storage_context = StorageContext.from_defaults(vector_store=vector_store)

# 4. Load Data

# SimpleDirectoryReader is versatile. In a real app, you might pull from APIs

print(f"Loading documents from {documents_path}...")

try:

documents = SimpleDirectoryReader(documents_path).load_data()

except Exception as e:

print(f"Error loading data: {e}")

return None

# 5. Build the Index

# This step chunks the documents, embeds them using Gemini, and pushes vectors to Qdrant

print("Indexing data... this may take a moment.")

index = VectorStoreIndex.from_documents(

documents,

storage_context=storage_context,

)

print("Indexing complete.")

return index

# Usage (assuming you have a folder named 'financial_news_data' with .txt files)

# index = create_financial_index()In a real-world scenario, you would likely integrate this with MLOps tools. Keeping an eye on MLflow News and Weights & Biases News is recommended for tracking embedding drift over time, especially as financial terminology evolves.

Section 3: Advanced Retrieval with HyDE (Hypothetical Document Embeddings)

This is where standard RAG tutorials often stop, but where high-performance financial applications begin. A major challenge in retrieval is the semantic mismatch. A user might ask, “How is the tech sector performing?” but the relevant document might say, “NASDAQ relies heavily on semiconductor gains amidst GPU shortages.”

Standard cosine similarity might miss the connection. This is where HyDE comes in. HyDE uses the LLM to generate a hypothetical answer to the user’s query. It then embeds that hypothetical answer and uses that vector to search the database. This aligns the search in the “answer space” rather than the “query space.”

This technique is gaining traction across LangChain News and Haystack News, but LlamaIndex’s implementation is particularly clean. It leverages the reasoning power of Gemini to hallucinate a plausible financial update, which acts as a perfect search query for the actual news.

from llama_index.core.indices.query.query_transform import HyDEQueryTransform

from llama_index.core.query_engine import TransformQueryEngine

def setup_hyde_query_engine(index):

if not index:

return None

# 1. Initialize the HyDE Transform

# We instruct HyDE to generate a financial news snippet

hyde = HyDEQueryTransform(include_original=True)

# 2. Create the Base Query Engine

# similarity_top_k=5 ensures we get diverse perspectives

base_query_engine = index.as_query_engine(similarity_top_k=5)

# 3. Wrap with HyDE

# This creates a pipeline: Query -> HyDE Generation -> Embedding -> Qdrant Search -> Synthesis

hyde_query_engine = TransformQueryEngine(base_query_engine, query_transform=hyde)

return hyde_query_engine

# Example Usage

# engine = setup_hyde_query_engine(index)

# response = engine.query("What is the impact of inflation on Indian tech stocks?")

# print(response)By using HyDE, we significantly improve the retrieval recall. This is vital when dealing with the nuances of market movements discussed in Bloomberg or Reuters style reports. While Cohere News often discusses their reranking models (another valid approach), HyDE offers a generative approach to relevance that works exceptionally well with capable models like Gemini.

Section 4: Building the Chat Loop and Best Practices

Once the engine is built, we need an interface. While we can use Streamlit News or Gradio News to build a web UI quickly, the core logic resides in a stateful chat loop. Financial analysis is rarely a single-shot query; it requires follow-up questions.

We must also consider the “Knowledge Cutoff” and hallucination risks. In the code below, we implement a simple loop that maintains context.

def start_financial_chat(index):

# Convert the index to a chat engine

# "context" mode retrieves relevant context from Qdrant for every message

chat_engine = index.as_chat_engine(

chat_mode="context",

system_prompt=(

"You are a sophisticated financial analyst bot. "

"Use the provided context from financial news to answer questions. "

"If the answer is not in the context, state that you do not have that information. "

"Do not speculate on future stock prices."

)

)

print("Financial Bot Ready. Type 'exit' to quit.")

while True:

user_input = input("You: ")

if user_input.lower() in ['exit', 'quit']:

break

try:

# The chat engine handles history and context retrieval automatically

response = chat_engine.chat(user_input)

print(f"Bot: {response}")

# Optional: Inspect sources

# print("Sources used:")

# for node in response.source_nodes:

# print(f"- {node.metadata.get('file_name')}")

except Exception as e:

print(f"An error occurred: {e}")

# To run the full stack:

# index = create_financial_index()

# start_financial_chat(index)Optimization and Production Considerations

Moving from a script to a production application involves several layers of optimization. Here is a checklist for the serious developer:

- Latency vs. Accuracy: HyDE adds latency because it requires an extra LLM call before searching. If speed is critical (e.g., high-frequency trading support), consider using NVIDIA AI News accelerated inference or TensorRT News optimizations for the embedding models.

- Vector Store Scalability: As your news dataset grows to millions of articles, you will need to utilize Qdrant’s distributed deployment features. Monitoring tools found in Datadog or specialized AI monitoring like LangSmith News become essential.

- Model Selection: While we used Gemini, the ecosystem is vast. Meta AI News with Llama 3, or Mistral AI News with Mixtral are viable open-source alternatives that can be hosted locally using Ollama News or vLLM News for data privacy—a huge concern in finance.

- Hybrid Search: Qdrant supports hybrid search (keyword + vector). In finance, specific tickers (e.g., “$TSLA”) are exact keywords. Relying solely on vectors might dilute the specificity. Combining sparse and dense vectors is a best practice.

Conclusion: The Future of Financial Search

Building a financial news chatbot with Qdrant, LlamaIndex, and Google Gemini is more than just a coding exercise; it is a step toward democratizing financial intelligence. By leveraging the speed of Qdrant and the reasoning of Gemini, developers can create tools that parse complex market narratives in real-time.

The landscape is shifting rapidly. With Azure AI News and AWS SageMaker News constantly releasing new managed vector solutions, the competitive bar is high. However, the composability of the stack presented here—decoupled storage, orchestration, and intelligence—provides the flexibility needed to adapt.

As we look forward, the integration of AutoML News for optimizing chunk sizes and Hugging Face News for domain-specific financial embedding models will further refine these systems. The next step for you is to take this code, ingest a live RSS feed of market data, and witness the power of RAG firsthand. Whether you are tracking crypto via Chainlit News interfaces or analyzing forex markets, the tools are now in your hands to build the future of fintech.